Car Sales Decrease while Subprime Auto Loans Increase

U.S. car sales have dropped 3 percent, making it sixteen months in a row of lower year-by-year sales. Additionally, vehicle sales have fallen to their lowest point since 2014. While this is occurring, risky car loans and fraud are on…

Avoid Using Loans for These Financial Issues

Loans make it feel like debts can be easily paid off, and it can be incredibly tempting to take out loans to solve your financial troubles. However, it’s not always worthwhile. Here are some times where taking out a personal…

What to do Before Filing a Renters Insurance Claim

Having renters insurance is a great way to be prepared, especially for young renters and college students. However, some preparation is also needed before filing a claim (if need be). Have replacement coverage. Although this is optional, it’s helpful to…

Health Insurance Facts You Didn’t Know

When looking for a health insurance plan, there are a few things you’ll need to keep in mind to make sure you don’t pick the wrong one. Here are a few tips to keep in mind. Learn what coinsurance means…

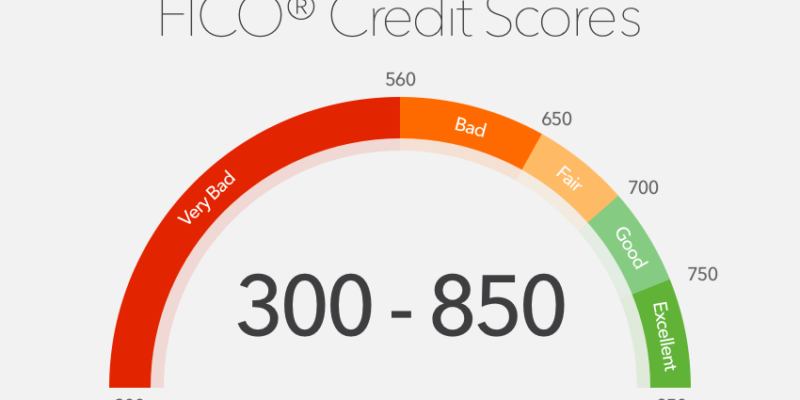

Rewards Cards for Those with Poor Credit

Having a poor credit score is stressful, and bringing it up to a good place only weighs on you more. It’s particularly hard to get a new credit card when your score is low, too. Here are some good rewards…

Build Your Credit Score with a Lending Circle

Lending circles are a great way for people who are unable to qualify for credit cards to kickstart their credit. A lending circle is a type of installment loan where a group of people put money into a pool each…

Quick Fix for Improving Your Credit Score

We all know that credit scores are important, and keeping them up can sometimes feel difficult. Here are some tips for improving your score quickly and easily. Credit utilization: The higher your credit utilization, the lower your score will be….